| Monday, February 16, 2004 |

| Copenhagen to Toulouse direct |

Thomas says: Thomas says:"On the 29th of March Maersk Air will open the route Copenhagen to Toulouse, which will be the first direct flight since I arrived in Toulouse. I have done a few searches and it seems like they only fly from Toulouse to Copenhagen on Mondays which is not that good since it rules out weekend visits, but the positive thing is that the trip will only take 2 hours and 15 minutes and will cost around 108 Euro per adult. Before you had to fly through Germany, Paris or Amsterdam and the cheapest tickets cost around 250 Euro."That's great news, even if it is just Mondays! Easier for our family to get here, and more likely that we can make the trip home more often. Gee, cheap direct flights to anywhere but London and Paris seemed like such an unobtainable luxury. [ Information | 2004-02-16 14:56 | 6 comments | PermaLink ] More > |

| Middleclass Poverty |

Now that it looks like my own economy is looking up a little bit for the moment, I can more comfortably write about the ups and downs of poverty. No, not the kind of poverty where you're living in a cardboard shack in the third world and there are no crops, no food, and no clean water, as I haven't personally experienced that. But the kind of poverty one can experience in a rich western country when one is trying to make ends meet, and they don't quite meet, no matter how fast one runs, and one never quite manages to do things the logical and sensible way. Now that it looks like my own economy is looking up a little bit for the moment, I can more comfortably write about the ups and downs of poverty. No, not the kind of poverty where you're living in a cardboard shack in the third world and there are no crops, no food, and no clean water, as I haven't personally experienced that. But the kind of poverty one can experience in a rich western country when one is trying to make ends meet, and they don't quite meet, no matter how fast one runs, and one never quite manages to do things the logical and sensible way.

A lot of things in a capitalistic society are arranged to provide economic incentives to do things the "right" way. You know, you get fines of various kinds if you do it the "wrong" way. And maybe a lot of that makes sense if you're sitting with a spreadsheet and calculating how to distribute your funds over the next couple of years. But it often becomes a very cruel arrangement when one lives from paycheck to paycheck and somehow has dug oneself into a hole one can't just step out of. A typical example is that you have a car, but you can't afford the insurance. Can you really be considered to be poor if you have a car and live in a house with a yard? Well, in some places you'd be considered rich. But if you live in Los Angeles you've probably gotten the idea that those are the basic necessities of life. So maybe it is an old car, but you have one or two, unless you're homeless. So, for the example, there was a period of time where I couldn't afford the $4-500 per month for car insurance, so I didn't have any. And I got stopped by the police, and in court the judge gave me a fine of $800 and graciously he gave me a few months to pay for it. Now, if I was the spreadsheet person with money in the bank, I can quickly make the calculation that it would be cheaper just to have the insurance and anything else I'm supposed to have. But if I'm just somebody who didn't have the money? OK, then I owe another $800. Does that motivate me to pay that plus the insurance I couldn't afford? Well, yes, but it certainly doesn't make it easier. So, I didn't pay that either. So at some point when I had parked somewhere, the car got impounded by the police. Which costs $10 per day in storage fees, plus a few hundreds of other fees, plus you have to pay everything you owe to get your car back. Which took me a couple of weeks to come up with, and it was way over $2000 at that time. And I still needed to go and get insurance. To a lot of good citizens that just means I'm an idiot and I could just keep my stuff in order in the first place. So, I'm trying to explain that there's a different kind of world, where it isn't just a matter of "keeping it in order", but a matter of how expensive it is to be a little behind rather than a little ahead, and how difficult it is to keep up with the Joneses, even if badly. Another example. After I went bankrupt 12 or so years ago I was quite happy with not having any credit lines. Declaring bankrupty was a relief, after realizing my fixed expenses were more than $7000 per month, and that there were no way of meeting them, let alone eat, if I earned less than that. Even if I earned what under other circumstances would be considered a very handsome living. So since then the policy was to not buy anything I didn't have the money for in cash. But, well, sooner or later we got credit cards again, for the convenience of buying things remotely. And I paid them every month in full, until some point this year where things were wearing a bit thin, and they ended up more or less maxed out. Not a lot of money, but $4000 or so. Which I didn't pay very much attention to at first. But now recently, where I only had barely what we needed for survival, I noticed what it actually was costing, even though I hadn't used these cards for a long time. I also notice that things were carefully arranged to make it really expensive to be close to the maximum. Each month I paid the amount suggested by the credit card company, on time. But each month each of the cards still went "over limit", which added a $30-40 extra charge for each card. Notice, I'm not using those cards, just paying the monthly amount. Still it was more than $200 per month. And now recently my U.S. checking account was out of commission because of my problem with Budget Rent-a-car, so I couldn't pay the cards at all for two and a half months. That ended up costing about $800 in charges for those same credit cards. And this all, of course, motivates me to "keep my things in order". Yeah sure. One thing takes another. A bit of a vicious cycle. So if you just are busy with work and life, and trying to pay your rent and your car insurance and avoid that the electricity gets turned off, and so forth, then at the end of the year I might notice that I don't really have the $20K that the IRS would like to be paid. So they add a lot of charges and fines to it, and make an agreement with me that is carefully calculated so that I never ever will finish paying off, as I'm only paying the interest. And, well, with all of that you don't really get around to doing sensible things like putting money away for your retirement, or even having one month worth of expenses in reserve. Because there's always some kind of emergency you need to deal with. Or when one month there isn't, you decide to then get health insurance, which leaves you stuck with another $600 a month. Or you decide to buy a new computer or go to a conference or something. Mind you, I haven't really made less than $60K a year for the last 18 years, and often twice as much. I've never worked less than 80 hours a week in that time. And it is not like we've had an extravagant lifestyle. Old cars, second-hand furniture, hardly any clothes shopping, kids in public schools, lower middleclass neighborhood. And at the times I've been having job jobs together with other more normal people, I've noticed how lots of them who earned less than me seemed to spend all the time talking about their mortgages, their retirement accounts, their stock market investments, their $40K cars, the college funds for their kids, and their vacation in Bora Bora, and mysteriously they seemed to have their affairs perfectly in order. So, am I just a little stupid and bad at math? Oh, that might be, and lots of people will probably conclude that. But that isn't my main point here. OK, for some folks it comes completely natural to do the right thing, and they seem to be in synch with the economic rules of society. But there are lots of other well-intended and hard-working folks, most in dual-income households, often in a much lower pay range than what I'm usually blessed with, but who also are stuck in similar or worse vicious cycles. Having bad credit and therefore getting worse rates on everything. Owing back taxes, having credit card bills, car payments, and spending way too much money on stupid late fees, and never quite getting their heads above water. There are various possible avenues of answers, of course. One could make a lot more money so that one could comfortably pay for the same lifestyle one's neighbors have. One could succeed in adopting a regimen where one keeps a sensible budget and sets aside reserves. One could get a stable job with a company that draws your taxes every month and sets aside retirement money and profit sharing for you. One could simplify one's life greatly and grow one's own food and forget about cars and cable TV. One could dream up a different kind of society that doesn't keep most of its citizens stuck in a rat's maze. Anyway, poverty sucks. [ Diary | 2004-02-16 17:59 | 4 comments | PermaLink ] More > |

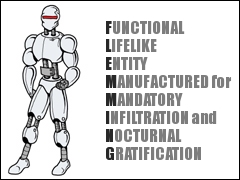

| Cyborg Name Generator |

Seen on Shadow Central, this is my code from the Cyborg Name Generator. OK, I thought it was gonna be stupid, but this is not half bad. Seen on Shadow Central, this is my code from the Cyborg Name Generator. OK, I thought it was gonna be stupid, but this is not half bad.[ Inspiration | 2004-02-16 18:24 | 13 comments | PermaLink ] More > |